Our Unicorn Financial Services PDFs

Wiki Article

The Ultimate Guide To Unicorn Financial Services

Table of ContentsNot known Incorrect Statements About Home Loan Broker Melbourne The smart Trick of Home Loan Broker Melbourne That Nobody is Talking AboutGetting My Melbourne Broker To Work10 Simple Techniques For Refinance Broker MelbourneThe Basic Principles Of Mortgage Broker Melbourne The smart Trick of Unicorn Financial Services That Nobody is Talking About

Mortgage brokers can aid those that have difficulty qualifying for a home mortgage! Home loan brokers are flexible and also want to see you prosper in buying a home.One point virtually every residence customer watches for is affordability. Acquiring a house is a huge purchase. So we recognize the wish to conserve cash where you can. Collaborating with a broker implies getting your house at wholesale as well as not retail, which can assist you out on rates of interest.

The smart Trick of Unicorn Financial Services That Nobody is Talking About

Eagle Home mortgage Firm intends to help obtain you there. Occasionally things obtain in the means, as well as we discover that dealing with financial institutions is one of those things. We wish to make the procedure as very easy as feasible. In the end, financial institutions want cash. We want you to locate the house of your dreams.We lie in Omaha, NE, yet help throughout Nebraska and also Iowa!.

When buying for a home loan, lots of residence customers get the solutions of a Mortgage Professional. There are numerous advantages to using a Home mortgage Broker and I have put together a list of the leading 8: 1. Saves you time Mortgage Brokers have access to multiple loan providers (over 50!). They collaborate with lenders you have actually come across as well as lenders you probably have not come across.

Getting The Loan Broker Melbourne To Work

2. mortgage brokers melbourne. Conserves you cash Mortgage Brokers, if they are successful, have actually accessibility to marked down rates. Due to the high volume that they do, lending institutions provide reduced rates that are not readily available straight with the branch of the lending institution that you go to. 3. Saves you from becoming stressed! It can be extremely difficult to locate a home loan.Your Mortgage Broker will see to it all the documents is in place. They will certainly maintain in excellent communication with you to make sure that you understand what is going on with your home mortgage and will keep you approximately date with any kind of problems to ensure that there are no surprises. 4. Offers you accessibility to lending institutions that are otherwise not available to you Some loan providers function exclusively with Home loan Brokers.

Providers are totally free Home mortgage Professionals are paid by the lending institution as well as not by you. A great Home loan Broker will certainly Constantly have the ideal interest of the customer in mind since if you, as a client, are satisfied, you will go inform your pals regarding the service you have actually obtained from the Mortgage Specialist you work with.

Things about Mortgage Broker In Melbourne

6. Handle every difficulty As Home loan Professionals, we see every scenario out there as well as work to make sure that every customer recognizes what is offered to them for financing choices for a mortgage. Damaged credit scores as well as low household income could be a deterrent for the bank, however a Home mortgage Professional recognizes just how to come close to the loan provider as well as has the partnership to ensure every client has a plan and method in position to ensure there is a home mortgage in their future.

8. The Home mortgage Broker has a far better understanding of what mortgage products are available than your Recommended Reading financial institution Remarkably, a Home Loan Broker has actually to be licensed and also can not review home loans with you unless they are accredited. This differs the financial institution who can "inside train" their team to offer the particular items readily available from their bank. https://usatopbizdirectory.com/mortgage-broker/unicorn-financial-services-springvale-victoria/.

5 Easy Facts About Unicorn Financial Services Explained

While this is not an extensive listing on the advantages of utilizing a Home loan Professional, it is compelling to see the benefits of utilizing a Mortgage Expert instead of putting a home mortgage together on your own (https://bestlocalcitations.com/mortgage-broker/unicorn-financial-services-springvale-victoria/). At Dominion Lending Centres, we have an exceptional relationship with the loan providers we present our customers to.

We are constantly expert and also we always ensure our clients understand every feasible choice they have for home loan funding.

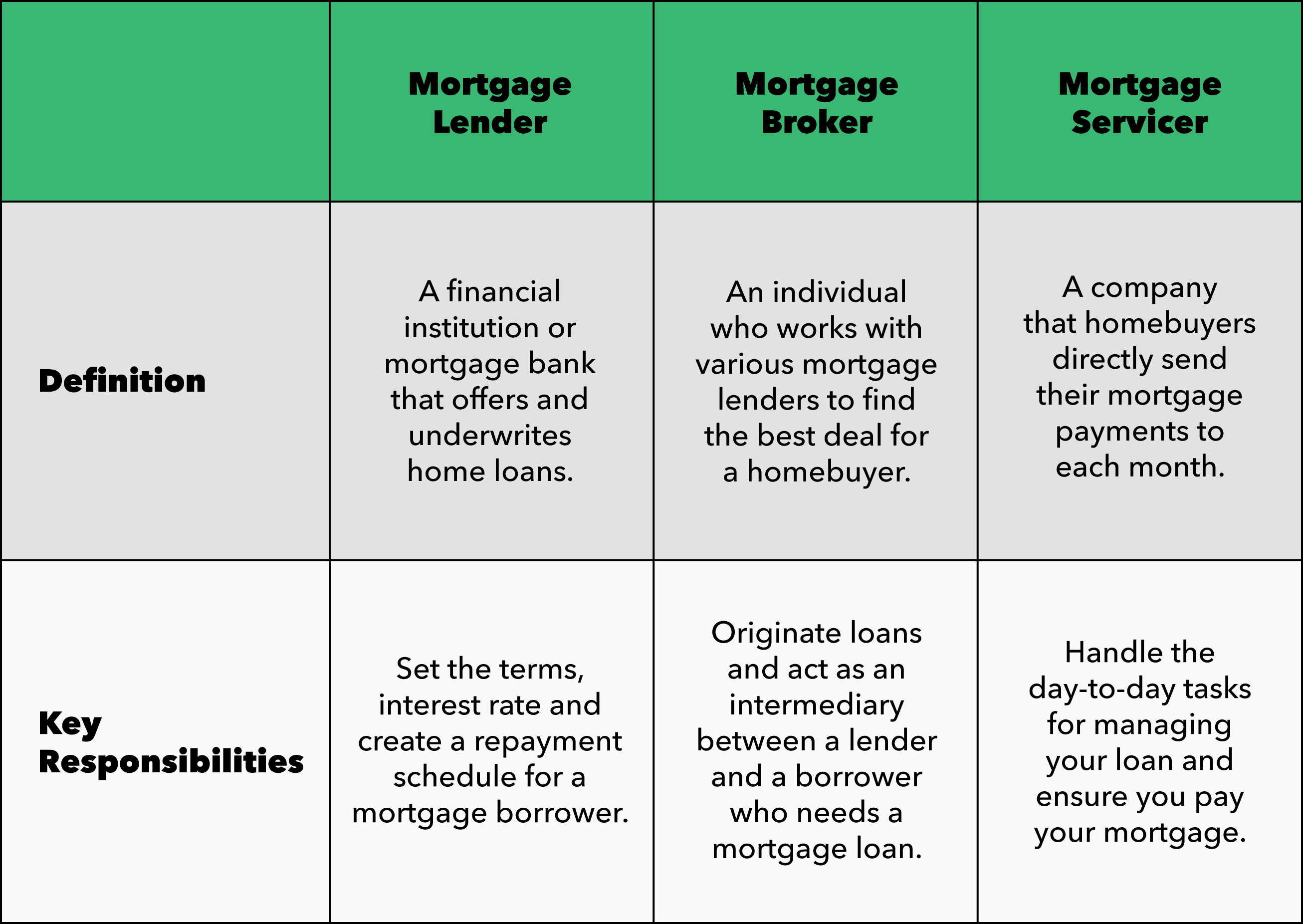

A home mortgage broker can assist if you want assistance sorting via finance options, identifying the most effective rate of interest or overcoming intricate borrowing challenges. You can go shopping for a residence funding by yourself, a mortgage broker serves as a matchmaker to connect you with the appropriate loan provider for your requirements - refinance melbourne. A home mortgage broker, unlike a mortgage loan provider, does not money car loans however instead aids you locate the ideal lending institution for your monetary situation. Mortgage brokers are certified as well as controlled economic specialists that act as a bridge between consumer and loan provider. A broker can have accessibility to a range of lending institutions, which might give you a bigger selection of products and also terms than a straight lender.

About Melbourne Broker

Brokers can come from financings and manage the authorization procedure, which can save you time, but they do not close home loans themselves. After you pick an ideal loan provider, your broker will certainly assist you assemble your documents, send it to an expert as well as order a house assessment. When you are cleared to shut, the mortgage broker will certainly begin to plan for shutting day.Report this wiki page